- Throughout the FHA Money

- Criteria

- Prices

- How to Implement

- Design Funds

- Condominium Recognition

- Are produced Cellular

- Energy efficient Financial

- FHA 203K Finance

The very thought of lifestyle for less grew to become much more attractive to people who want to increase their money even further. The brand new average checklist rate to own unmarried-friends house, condominiums, townhomes, and you can co-ops into the is $340,100, upwards thirteen.cuatro per cent compared to the just last year, predicated on Real estate professional.

A significant price raise is an excellent signal to own providers but a prospective roadblock for most very first-time homeowners lacking numerous finance having a down payment. FHA finance is preferred among first-big date homebuyers as they only need good step 3.5% minimal down payment. The credit rating requirements commonly since the tight, often. More youthful homeowners will choose this choice whilst also provides a less costly replacement a normal loan. FHA loans can be used to purchase manufactured land, modular land, single-friends residential property and you can condominiums.

Are created residential property bring an alternative to to purchase one-loved ones residential district domestic otherwise condo and supply a comparatively reasonable road so you’re able to homeownership.

Depending on the Are created Houses Institute, an estimated 22 billion anybody live in are produced casing. 90 percent of those men and women are satisfied with their houses.

In this article, we are going to look closer on FHA are available home loan conditions, also the required steps to track down you to.

What exactly is an FHA Are made Mortgage?

FHA Are produced land are built into the production facilities and you will follow framework and defense standards place because of the U.S. Institution off Construction and Urban Innovation, otherwise HUD.

Tips Finance a keen FHA Were created Household

The latest Agencies regarding Property and Urban Development (HUD) even offers mortgage software to own are created belongings through the Federal Housing Government mortgage system, including Identity We and you can Term II fund.

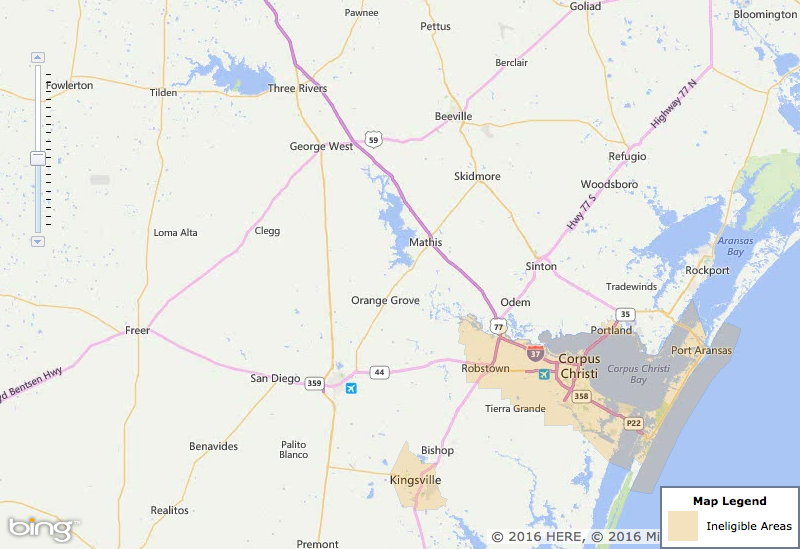

FHA Title We finance is actually repaired-price fund designed for home improvements, solutions, and buying are formulated house even when the customer does not own otherwise propose to buy the land your house occupies. They actually do feature amount borrowed and you may label limits since intricate of the HUD less than:

FHA Name II finance are fixed-rates money designed for financing are available residential property and you may residential property sold together with her, above the Term We amount borrowed and you can term limitations. Label II fund fall into FHA’s federal conforming mortgage restrictions having Single-Family land. The maximum amount borrowed happens to be $356,362 and you will adjusts annually. Mortgage term alternatives for Identity II loans was fifteen and 31 decades.

Are designed, Cellular & Modular Home: What’s the Distinction?

Were created belongings was basically immediately following entitled and you can known as mobile belongings. Some individuals might still refer to are manufactured belongings given that cellular actually if for example the domestic isn’t really officially cellular.

Are built Homes Are receiving Increasingly popular

Recently released research regarding the installment loans Hamilton TX U.S. Census Agency shows that just how many are made belongings are shipped throughout the U.S are growing yearly.

This is actually the latest snapshot of the Newest Were created Property Survey away from October out-of last year proving what amount of are made belongings shipped in america.

The following is a review of the common sales price of are available land being sold within the last five years. The average sale price of a created home just last year is a little over $87,000. If you decided to contrast this towards cost of to get a vintage home, which is around $250,100000 inside deals.

Summary

What number of the latest are formulated belongings on the U.S. are growing, so there is no doubting the increased need for efficient, affordable housing. While looking for a house, possible most likely getting extremely finances-aware.

For those who have issues, or you’re not knowing in the event the to order a created residence is an educated selection for you, please talk to an FHA-acknowledged financial to go over your options.